2021 electric car tax credit irs

There are many tools that exist online and at IRSgov to better understand electric vehicle tax credits the credit amount per. Web Say you purchase a 40000 Volkswagen ID4 an electric crossover eligible for the entire 7500 credit.

How Do Electric Car Tax Credits Work Credit Karma

If your total tax liability for that year only adds up to 5000.

. Federal tax credit for EVs will remain at 7500. Beginning in 2023 qualifying used EV purchases can fetch taxpayers a credit of up to 4000 limited to 30 of the cars purchase price. Timeline to qualify is extended a decade from January 2023.

Web New Federal Tax Credits under the Inflation Reduction Act. Web The Federal Tax Credit for Electric Vehicle Chargers is Back. Web Electric Vehicle Tax Credit for 2022 2023 eFile.

For instance Teslas EVs were eligible for the full 7500 credit until the end of 2018 and then the. Web 421 rows Federal Tax Credit Up To 7500. 5 hours ago The IRS tax credit for 2022 ranges from 2500 to 7500 per new electric vehicle EV purchased for use in the US.

All-electric and plug-in hybrid cars purchased. For vehicles acquired after. Web The IRA remedies this.

This is because the electric vehicle tax credit is. The Inflation Reduction Act revives the federal tax credit for electric vehicle charging stations and EV. Web In the case of Feigh vCommissioner 152 TC No.

Web The Internal Revenue Service has provided some preliminary guidelines regarding the EV tax credit and its immediate future. Web If you meet the income requirements and buy a qualifying vehicle you must claim the electric vehicle EV tax credit on your annual tax filing for 2022 and 2023. Web The federal tax credit for EVs tapers down once the automaker sells 200000 eligible cars.

Web Internal Revenue Code Section 30D provides a credit for Qualified Plug-in Electric Drive Motor Vehicles including passenger vehicles and light trucks. 15 the IRS was found to have effectively created an unintended double tax benefit for receipt of a Medicaid waiver. Web remove the limitation on the number of vehicles per manufacturer that are eligible for the credit allow a taxpayer to assign the credit to a financing entity and.

Jeep 4xe Hybrid Tax Credits Incentives By State

Summary Of The Electric Vehicle Tax Credit

Tax Credit On Vehicle Home Ev Chargers Irs Form 8911 Youtube

Ev Tax Credits Are Changing What S Ahead Kiplinger

Top 15 Faqs On The Income Tax Credit For Plug In Vehicles

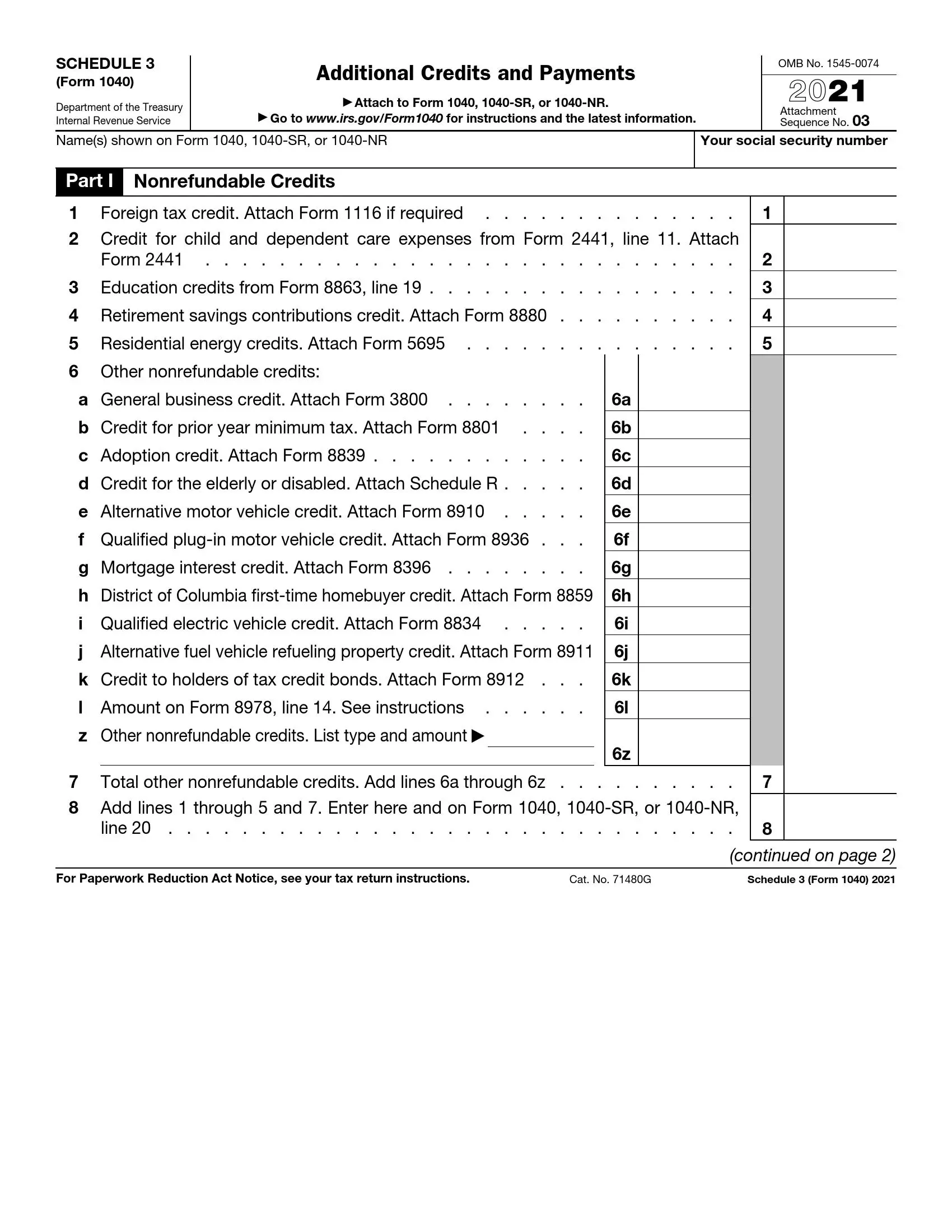

Irs Schedule 3 Form 1040 Or 1040 Sr Fill Out Printable Pdf Forms

Here Are The Cars Eligible For The 7 500 Ev Tax Credit In The Inflation Reduction Act Electrek

Audi Mini Toyota Prius Models Added To Irs Electric Vehicle Tax Credit List Don T Mess With Taxes

What Is Irs Form 8910 Alternative Motor Vehicle Credit Turbotax Tax Tips Videos

Audi Mini Toyota Prius Models Added To Irs Electric Vehicle Tax Credit List Don T Mess With Taxes

Irc 30d New Qualified Plug In Electric Drive Motor Vehicle Credit Internal Revenue Service

Electric Vehicle Tax Credits What To Know In 2022 Bankrate

Getting An Ev Tax Credit Is Getting Harder Can You Still Cash In Gobankingrates

:max_bytes(150000):strip_icc()/car-charging-at-electric-vehicle-station-1316428504-d9dfb89a0f8a4873b7dc0284646bea41.jpg)

What Is Form 8936 Plug In Electric Drive Motor Vehicle Credit

How The Federal Ev Tax Credit Can Save You Up To 7 500 On A Car

Irs Energy Dept Issue Guidance List Of Cars Eligible For Revised Ev Credit Roger Rossmeisl Cpa

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels

Small Business Tax Credits The Complete Guide Nerdwallet

Here S Every Electric Vehicle That Qualifies For The Current And Upcoming Us Federal Tax Credit Electrek