nh tax return calculator

New Hampshire Salary Tax Calculator for the Tax Year 202122 You are able to use our New Hampshire State Tax Calculator to calculate your total tax costs in the tax year 202122. Call Us Today To Schedule An Appointment With Us.

Getting Back Your Money How To Claim An Income Tax Refund Tax Refund Income Tax Personal Finance

To request forms please email formsdranhgov or call the Forms Line at 603 230-5001.

. - FICA Social Security and Medicare. Low Income Housing Tax Credit. Timber Gravel Tax.

Also we separately calculate the federal. If you have a substantive question. Line 10 The application will calculate the New Hampshire Interest and Dividends Tax and display the result.

Ad 100s of Top Rated Local Professionals Waiting to Help You Today. DO NOT USE FOR CURRENT TAX PERIOD FORM NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION NH1065 PARTNERSHIP BUSINESS PROFITS TAX RETURN For the. Deductions and personal exemptions are taken into account but some state-specific deductions and tax credit programs may not be accounted for.

Being taxed for FICA purposes. New Hampshire income tax rate. To request forms please email formsdranhgov or call.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Our free online New Hampshire sales tax calculator calculates exact sales tax by state county city or ZIP code. Ad Get Your Tax Return Done Right.

New Hampshire NH State Income Taxes. All groups and messages. This is an optional tax refund-related loan from MetaBank NA.

New Hampshire does not tax individuals earned income so you are not required to file an individual New Hampshire tax return. You can use our New Hampshire Sales Tax Calculator to look up sales tax rates in New Hampshire by address zip code. Were Here To Help You Save Time Money.

For taxable periods ending on or after December 31. Homeowners who disagree with their homes valuation can file an abatement request. Ad Get Your Tax Return Done Right.

To use our New Hampshire Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. That will generally lead to a review of valuation and a possible refund of taxes paid. New Hampshire Cigarette Tax.

- New Hampshire State Tax. Start filing your tax return now. Please consider there is no state.

Approval and loan amount. Organizations operating a unitary business must use combined reporting in filing their New Hampshire Business Tax return. Census Bureau Number of cities that.

Line 11 Enter payments previously made from an a application for extension b. Calculate your New Hampshire net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free New. Online Tax Return Preparation Services.

Real Estate Transfer Tax. Online Tax Return Preparation Services. Before the official 2022 New Hampshire.

That tax applies to both regular and diesel fuel. Were Here To Help You Save Time Money. The gas tax in New Hampshire is equal to 2220 cents per gallon.

Compare Tax Preparation Prices and Choose the Right Local Tax Accountants For Your Job. 0 5 tax on interest and dividends Median household income. It is not your tax refund.

As such New Hampshire Interest Dividends and Business Tax Business Profits Tax and Business Enterprise Tax returns that are due on Friday April 15 2022 will be due on. The calculator will show you the total sales tax amount as. New Hampshire Paycheck Quick Facts.

Call Us Today To Schedule An Appointment With Us. Additional details on opening forms can be found here. Of that amount being taxed as federal tax.

New Hampshire - Married Filing Jointly Tax Brackets. New Hampshire Gas Tax. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

Loans are offered in amounts of 250 500 750 1250 or 3500. New Hampshire Only Taxes Certain Income New Hampshire is one of two states that only taxes.

Tax Season 2022 When Can You File Taxes With Irs In 2022 Money

Form 1040x Amended Income Tax Return Legacy Tax Resolution Services

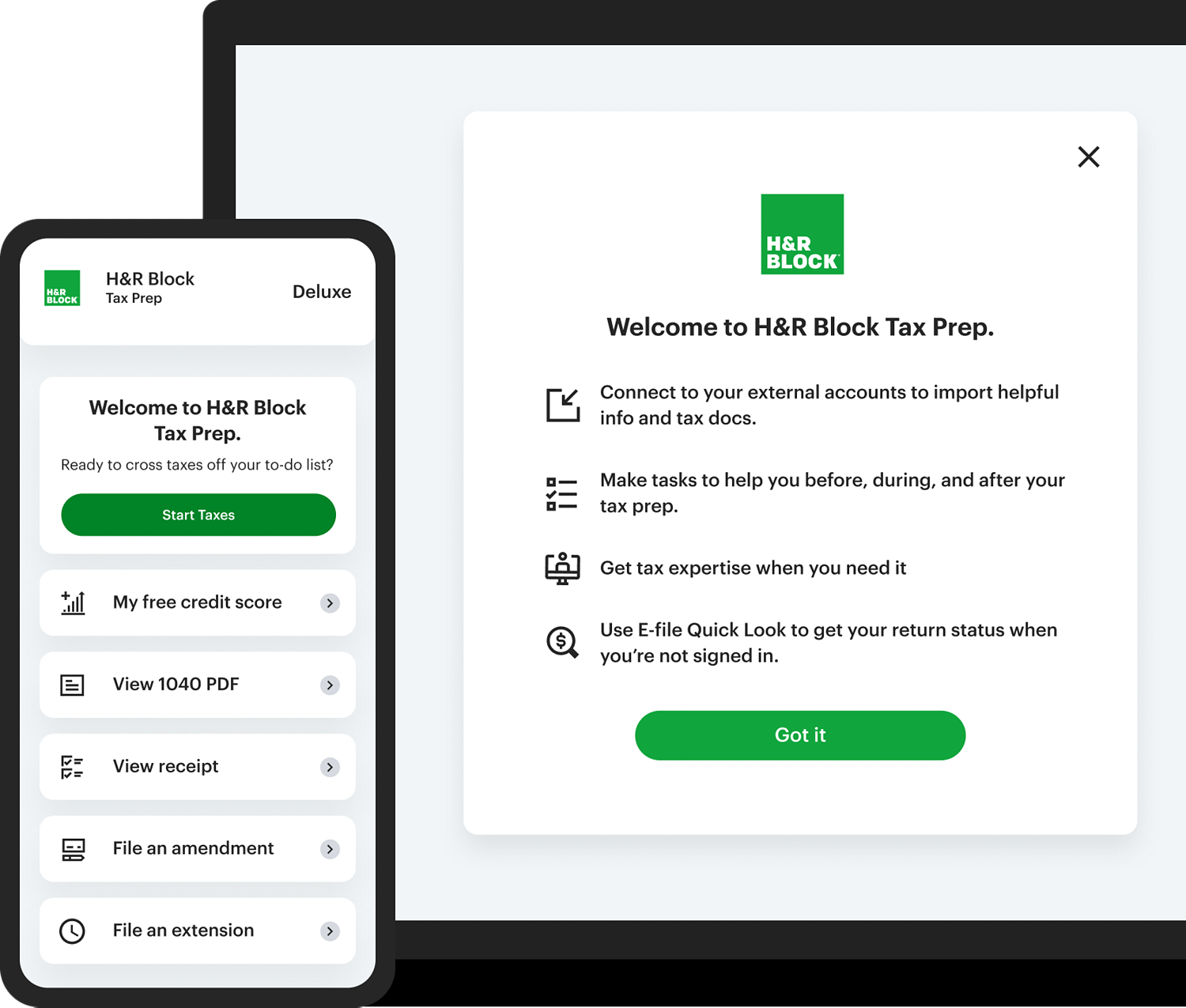

How To Fill Out A Fafsa Without A Tax Return H R Block

How To Easily Amend Tax Return Before Irs Catches Your Mistakes Internal Revenue Code Simplified

Where S My Refund How To Track Your Tax Refund 2022 Money

How To File Taxes For Free In 2022 Money

Taxes 2022 Important Changes To Know For This Year S Tax Season

How To Estimate Your Tax Refund Cnet

Want To Avoid High Taxes Retire In One Of These 10 States Retirement Money Choices Tax

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

New Hampshire Income Tax Nh State Tax Calculator Community Tax

Here S The Average Irs Tax Refund Amount By State

Deluxe Online Tax Filing E File Tax Prep H R Block

Changes In 2021 Aca Reporting Health Insurance Coverage How To Plan Irs Forms

New Hampshire Income Tax Nh State Tax Calculator Community Tax

There Are 9 Us States With No Income Tax But 2 Of Them Still Taxed Investment Earnings In 2020 Income Tax Income Tax

How To Easily Amend Tax Return Before Irs Catches Your Mistakes Internal Revenue Code Simplified

Taxes Due Today Last Chance To File Your Tax Return Or Tax Extension On Time Cnet